Filters

Filters

- Preparatory

- Course

- Economics Programs

- Money Management

Sort by

3 Money Management Course Programs

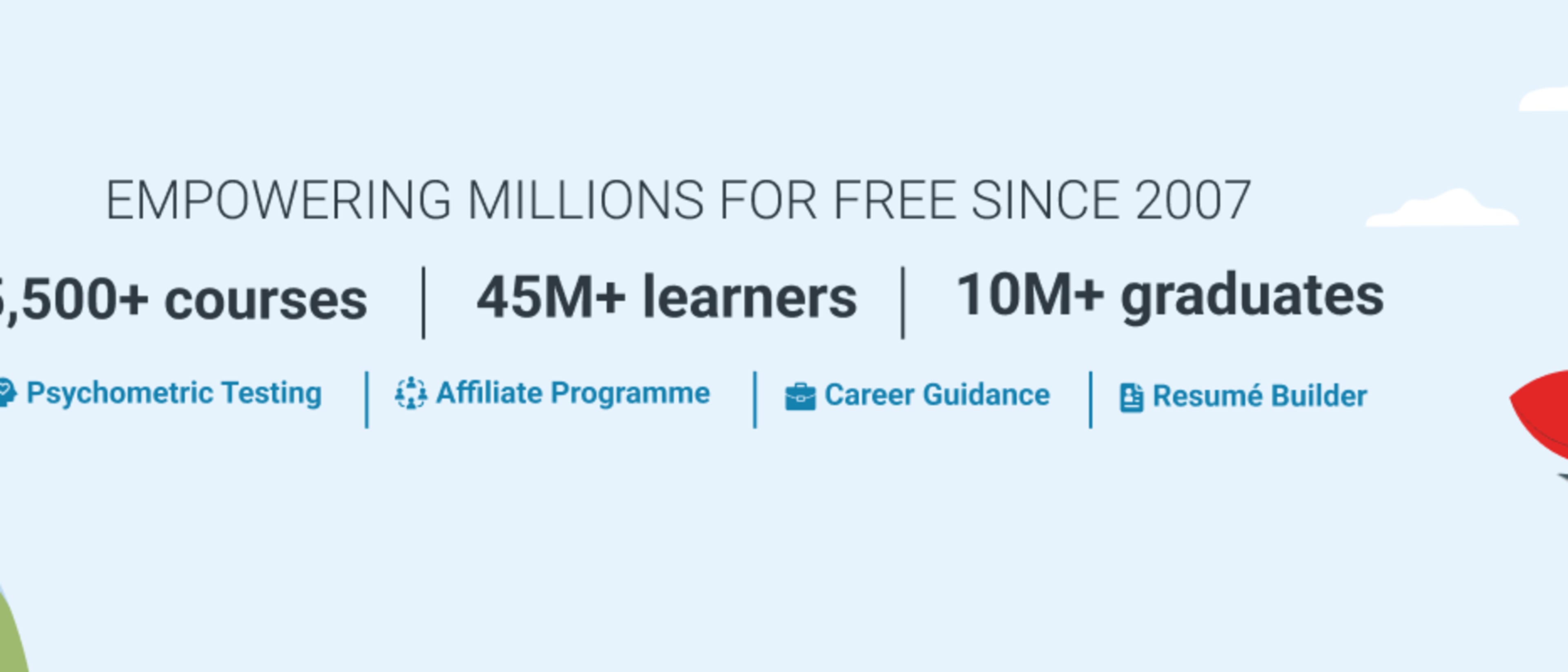

Alison Free Online Learning

Introduction to Anti-Money Laundering Regulations (Free Online Course With Certificate)

- Online USA

Course

Full time, Part time

1 hour

Distance Learning

English

Learn the strategies and methods involved in preventing money laundering with this free online course.

London Academy of Trading

Wealth Management

- Online United Kingdom

Course

Full time

2 weeks

Distance Learning

English

In the current economic climate, it is more important than ever to understand your financial priorities and make sure that you can make money work for you. Over the course of this two-week Wealth Management course, LAT will help you to achieve your specific financial goals. Through a combination of pre-recorded lectures and live interactive sessions, our specialist tutors will help you to understand the concepts of wealth management, tax planning and long-term investing.

Best programs for you

Answer a few questions and we'll match you with programs!

Massey University

Money Smarts @ Work

- Auckland, New Zealand

- Palmerston North, New Zealand

- + 1 more

Course

On-Campus

English

The course introduces some principles, tools, and techniques necessary for personal financial management. Offered by the NZ Fin-Ed Centre (Financial Education and Research Centre) Massey University, this self-paced, online course is ideally suited to the time demands of people in the workforce. Trials with employees have ensured that it is relevant and engaging.

Popular Economics Programs Money Management degree types

Popular study format

Popular locations

Learn more about Money Management Course programs

In Money Management degree programs at the Courses level, you’ll explore fundamental financial principles that drive personal and organizational economic decisions. This study area combines practical knowledge with analytical techniques, preparing you for a range of industry challenges.

Courses in money management often cover topics such as financial planning, investment strategies, and risk management. By analyzing case studies, you'll develop skills in budgeting, forecasting, and portfolio management. This environment encourages students to strengthen their adaptability while exploring concepts that are crucial for navigating today’s financial landscape.

Graduates typically pursue roles such as financial analyst, budget manager, or investment advisor, where they apply their skills to help individuals and organizations make informed financial choices. These programs not only prepare you for immediate employment but also lay the groundwork for advanced studies in finance or business administration.